How Financial Ratios Impact Bonding Capacity Surety bonding is a crucial requirement for contractors, businesses, and individuals engaged in public and private projects. One of the key determinants of bonding capacity is financial health, which is evaluated through financial ratios. Surety companies analyze liquidity, leverage, and profitability ratios to assess a company’s ability to complete a project successfully and fulfill its financial obligations. Liquidity Ratios Liquidity ratios measure a company’s… Read More

Archives for February 2025

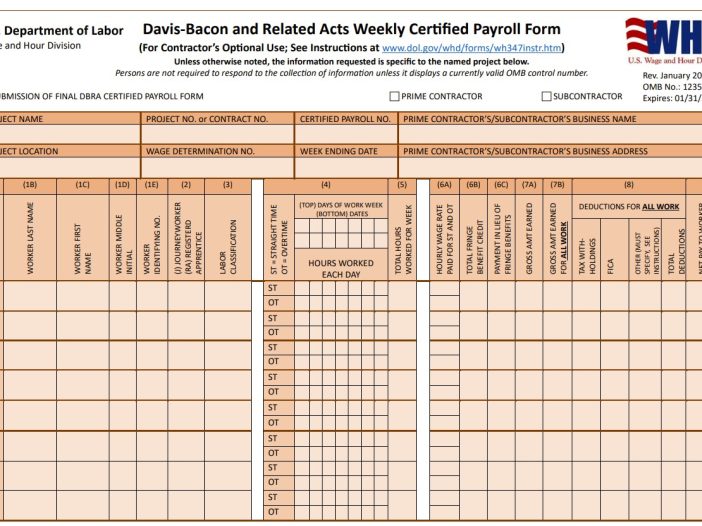

Understanding Prevailing Wages: A Guide for Contractors and Workers

Prevailing wages are a crucial aspect of the construction and government contracting industries, ensuring that workers receive fair compensation for their labor. For contractors, understanding and complying with prevailing wage laws is essential to maintaining compliance, avoiding penalties, and securing government contracts. In this blog post, we will explore what prevailing wages are, how they are determined, and why they matter for both employers and employees. What Are Prevailing Wages?… Read More

Maintain Strong Working Capital: A Key to Surety Bonding Success

For contractors, maintaining strong working capital is essential for securing and increasing bonding capacity. Surety bond underwriters closely examine a contractor’s financial health, and working capital (current assets minus current liabilities) is a primary indicator of a company’s financial stability. A contractor with strong working capital demonstrates the ability to handle current liabilities, fund ongoing projects, and maintain positive cash flow—all critical elements for securing larger bond limits. In this… Read More

Equipment Financing and Its Effect on Surety Bonding

For contractors, acquiring and maintaining equipment is a critical part of business operations. However, the way equipment is financed—whether through purchasing outright, leasing, or financing with debt—can significantly impact a company’s financial position and bonding capacity. Sureties closely examine a contractor’s financial health, including assets, liabilities, working capital, and debt levels, before issuing bonds. Understanding how equipment financing affects financial statements and bonding eligibility is crucial for contractors seeking to… Read More

Understanding Construction Accounting Roles: Office Manager, Bookkeeper, Controller, and CFO

In the early stages of a construction business, the owner often manages financial tasks themselves—tracking accounts receivable (A/R) and payable (A/P), overseeing payroll, and maintaining financial records. However, as the company and its projects expand, financial decision-making becomes too complex for one person to handle alone. This raises an important question: Should you hire an office manager, bookkeeper, controller, or CFO? And what sets them apart? Growth of a Contractor’s… Read More