Prevailing wages are a crucial aspect of the construction and government contracting industries, ensuring that workers receive fair compensation for their labor. For contractors, understanding and complying with prevailing wage laws is essential to maintaining compliance, avoiding penalties, and securing government contracts. In this blog post, we will explore what prevailing wages are, how they are determined, and why they matter for both employers and employees.

What Are Prevailing Wages?

Prevailing wages refer to the minimum hourly wage, including benefits, that must be paid to workers on public works projects. These wages are established by government agencies to reflect the compensation rates commonly paid for similar work in a specific geographic area.

Prevailing wage laws, such as the Davis-Bacon Act at the federal level, ensure that contractors working on government-funded projects do not underpay workers or engage in wage suppression to win bids unfairly.

How Are Prevailing Wages Determined?

Prevailing wages are set based on surveys conducted by government agencies, which collect wage data from local contractors, unions, and industry representatives. Factors that influence prevailing wages include:

- Job Classification: Wages vary depending on the type of work being performed, such as carpentry, electrical work, or plumbing.

- Geographic Location: Wages differ by state, county, or city, reflecting local economic conditions.

- Union and Non-Union Rates: In many cases, prevailing wages are influenced by collective bargaining agreements, particularly in heavily unionized areas.

- Fringe Benefits: Employers must also provide fringe benefits, such as health insurance and pensions, or pay additional compensation if they do not offer these benefits.

Government agencies publish prevailing wage rates for different trades and locations, making it essential for contractors to review these rates before bidding on public projects.

Why Do Prevailing Wages Matter?

For Workers:

- Ensure fair compensation, reducing the risk of exploitation.

- Promote job stability and skilled labor development.

- Provide access to benefits such as healthcare and retirement plans.

For Contractors:

- Level the playing field by preventing underbidding through low wages.

- Attract and retain skilled workers, leading to higher-quality work.

- Avoid legal issues and penalties by ensuring compliance with wage laws.

For Government and Communities:

- Support local economies by maintaining fair wages.

- Improve construction quality by incentivizing experienced labor.

- Reduce the reliance on government assistance programs by ensuring workers earn livable wages.

Compliance with Prevailing Wage Laws

Contractors working on federally funded or state-funded public works projects must:

- Review and adhere to prevailing wage determinations for each contract.

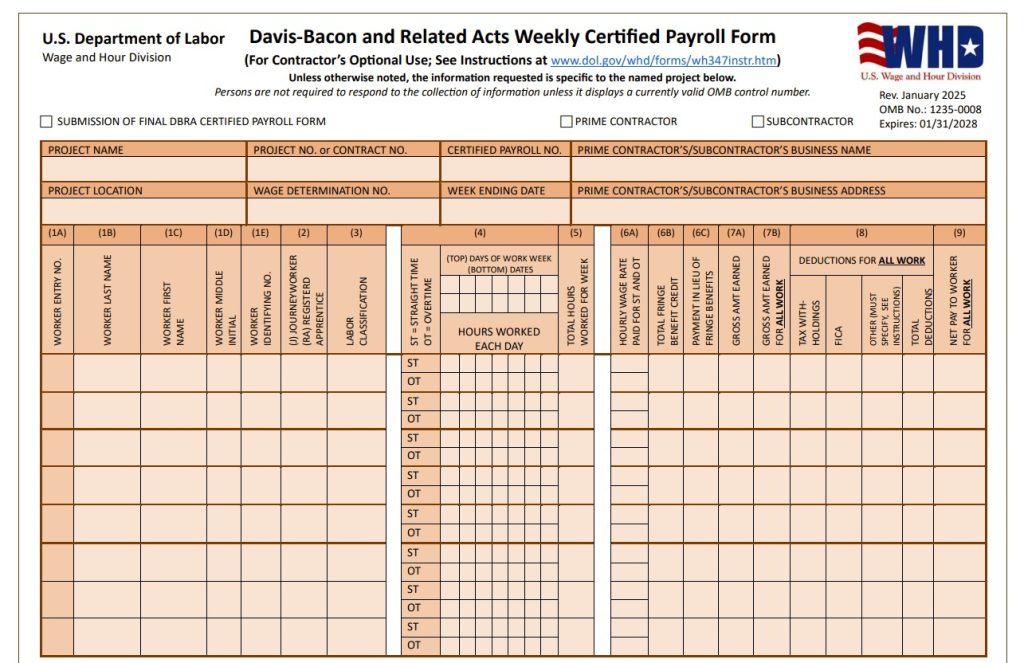

- Keep accurate payroll records and submit certified payroll reports.

- Ensure workers receive the correct wages and fringe benefits.

- Address wage disputes and rectify any underpayments promptly.

Non-compliance can lead to fines, contract termination, and disqualification from future government contracts, making proper adherence crucial for business sustainability.

Final Thoughts

Prevailing wages play a significant role in protecting workers and promoting fairness in government contracting. Contractors must stay informed about wage requirements, maintain compliance, and prioritize fair labor practices to ensure successful project execution. By understanding prevailing wage laws, both employers and employees can benefit from equitable compensation and industry stability.

If you are a contractor looking for guidance on prevailing wages, consider consulting with a construction accountant or legal expert to ensure full compliance with labor laws.