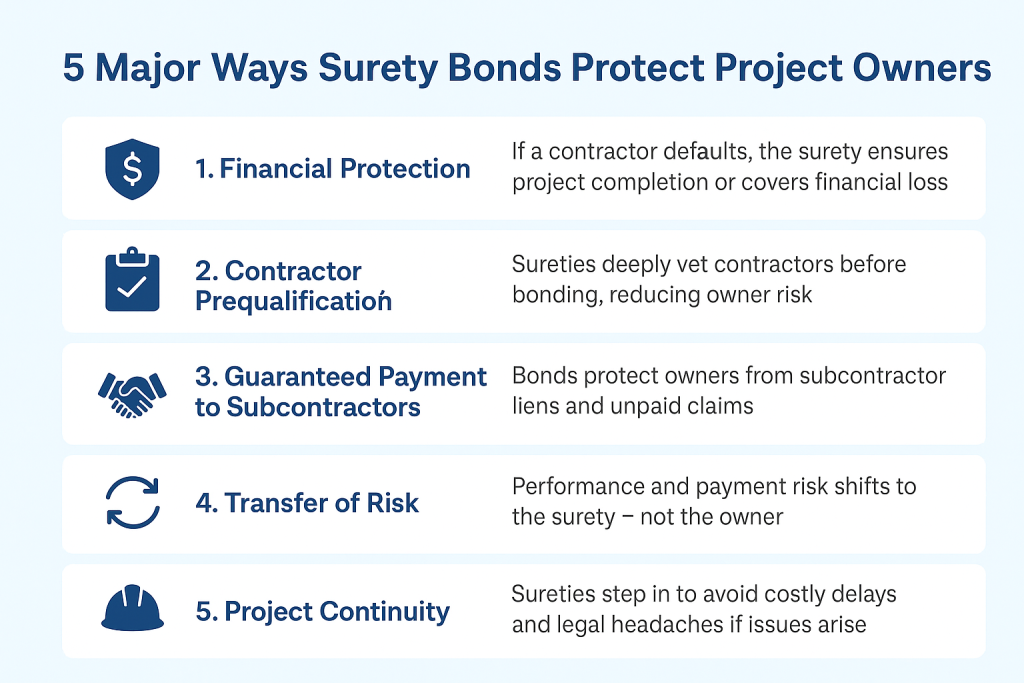

1. Financial Protection Against Contractor Default

If a contractor can’t finish the job — whether due to bankruptcy, poor management, or other issues — the surety steps in to ensure the project gets completed or the owner is financially compensated.

Without a bond:

The owner could be left scrambling, paying out-of-pocket to hire new crews, fix mistakes, or complete the project.

With a bond:

The surety absorbs the cost and responsibility, keeping the project moving.

2. Contractor Prequalification

Surety companies perform rigorous financial and operational reviews before issuing a bond:

- Financial strength and liquidity

- Experience with similar projects

- Management practices

- Credit history

- Job history and claims record

Bottom Line:

Owners get an extra layer of vetting — beyond their own due diligence — reducing the risk of choosing an incapable contractor.

3. Guaranteed Payment to Subcontractors and Suppliers

Payment bonds guarantee that subcontractors, laborers, and suppliers will be paid even if the general contractor defaults.

Why it matters to owners:

- Prevents liens on the project

- Reduces project delays from unpaid vendors walking off jobs

- Protects the project’s legal standing and financial health

4. Transfer of Performance Risk

When an owner requires bonding, they shift risk to the surety company.

If the contractor fails, the surety is legally obligated to step in.

This protects:

- Project timelines

- Budget integrity

- Owner reputation with stakeholders and investors

It’s smart risk management — especially for large public or private projects.

5. Project Continuity and Completion Assurance

In the event of contractor failure, sureties:

- Find and fund a replacement contractor

- Or provide financing to the existing contractor

- Or pay damages as stipulated by the bond

Result:

Owners minimize disruption, cost overruns, and legal battles.

🎯 Why Smart Owners Always Require Bonds

Construction projects are high-stakes investments.

Bonds act like a safety net — ensuring that even when unexpected issues arise, owners have protection.

In short:

- Bonds provide financial backing.

- Bonds vet contractors.

- Bonds guarantee project stability.

Without them, project owners take on all the risk.

🚀 Closing Thought

If you’re a project owner, requiring surety bonds isn’t just a box to check — it’s a critical investment in project success.

At Payless Taxes LLC, we help contractors strengthen their financials to qualify for larger bonds — and help owners understand how bonding protects their projects from start to finish.

Let’s work together to make sure your next project is built on a foundation of security and trust.

🔗 Reach out today!

#SuretyBond #Construction #RiskManagement #Contractors #ProjectOwners #PaylessTaxesLLC